Starting young with even a small amount of regular investments can pave the way to financial independence. Many people don’t realise the importance of planning for the future, often falling into the trap of spending and debt. This article will explore how young individuals, with the right financial knowledge and habits, can achieve financial freedom. We’ll discuss the power of compound interest, the basics of investing, and the benefits of starting early. We will also take a look at what just 10 euros/pounds/dollars a week could do for someone if they start investing when they leave school and keep investing this small amount until they retire.

Key Takeaways

- Starting early with investments allows more time for compound interest to grow your wealth.

- Understanding different types of investments and diversifying your portfolio can reduce risks.

- Financial education is crucial and should be prioritised to help young people make informed decisions.

- Regular, small investments can accumulate significantly over time, leading to financial independence.

- Shifting from a spending to a saving mindset can help overcome the culture of debt and lead to long-term financial stability.

- 10€ (or whichever currency) a week from an early age can set you up for retirement.

The Power of Compound Interest

What is compound interest and how it works

Compound interest is like a snowball rolling down a hill. It starts small but grows bigger over time. When you earn interest on your savings, that interest starts earning interest too. This cycle continues, making your money grow faster and faster.

It works like this: Imagine you save £100 and earn 5% interest each year. In the first year, you earn £5, so you have £105. In the second year, you earn interest on £105, not just £100. This means you earn £5.25, giving you £110.25. Over many years, this small difference adds up to a lot more money.

Example of compounding over time – for a tenner a week!

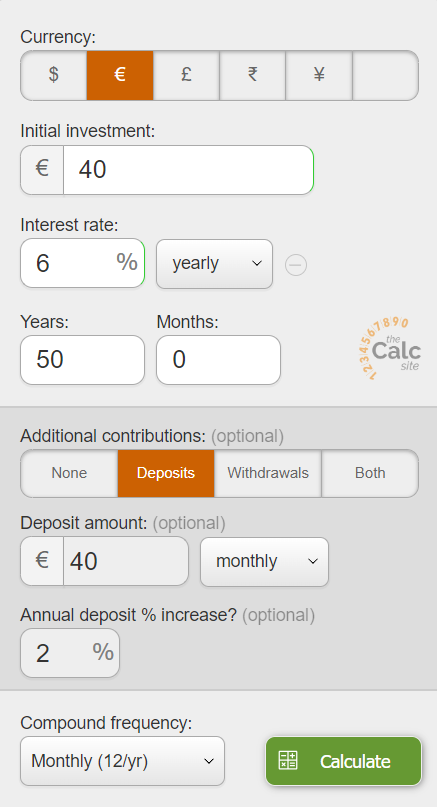

Let´s say a youngster starts out with a small savings amount of 10 euros (or whatever currency you work in) a week. We will keep it simple and say 40 a month from the age of 18 for 50 years until their retirement.

This is a small amount by most peoples standards so it´s realistic. If they maintain that investment every month and earn 6% per year (on average, I will explain in other articles why I use 6% as a figure) and increase their monthly amount by 2% a year (so from year 2 they pay 40.80 per month and so on). I have added this small incrementation in because we can usually expect to say that inflation runs around 2% and clearly, the income of someone starting out at 18 will go up in time as will the value of money. To be honest, 40 euros a month now will seem like nothing in a few years and so the liklihood is that the saver could significantly increase this contribution in a few years, but for now, jsut for the illustration we will say that the contribution remains the same and only increases by 2% per year.

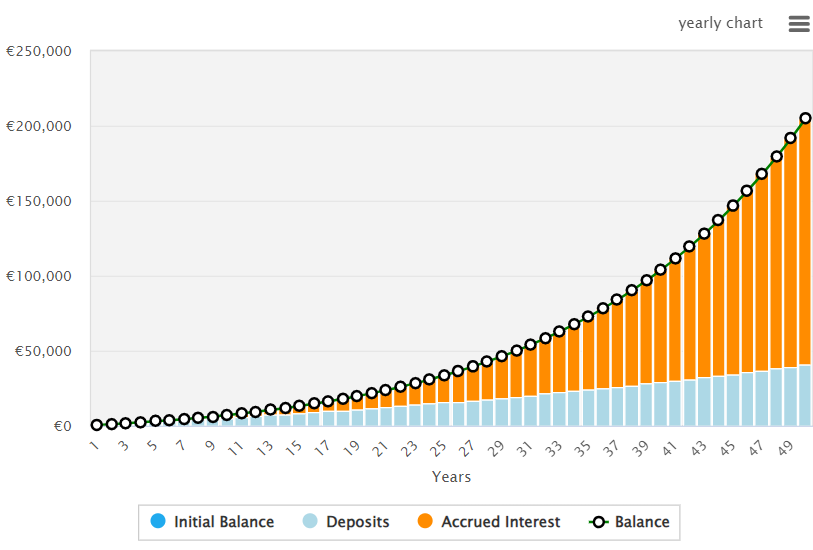

In 50 years that would be worth a whopping 205,000€! In the image below, the blue element shows the amount invested and the orange shows the growing interest! This is a powerful example of how even modest savings can lead to significant wealth accumulation over time. By starting early and being consistent, anyone can harness the benefits of compound interest to secure their financial future.

This image shows that based on the calculations mentioned above, over the 50 years investing period, by year 50, the amount invested each year will have grown to 1267 which is around 24 a week. The total saved will be 40,661 but a whopping 164,373 will have been accumulated in interest to bring the total to over 200k. That really shows the power in regular investing.

You can do your own calculations as shown by visiting the calculator site compound interest calculator which is a fun, easy to use and highly recommended tool. This tool can help you understand the impact of compound interest on your savings and investments.

The shocking reality of starting later

If we start with the same amount of 40 euros a month and increase it by 2% a year but only do this for half the time (25 years), so starting in mid-life, the results are shockingly different.

Here you can see that the total invested will be 15,421 with 18,200 in interest bringing the total pot to just over 33k. The difference in interest compounding and continuing to drip in for that longer period is huge. In fact the interest earned is almost ten times less!

Starting to save early is key. The earlier you start, the more time your money has to grow. Even very small regular amounts can turn into a large sum over time. This is why starting young is so powerful. But, sadly the majority of youngsters don´t save money, even small amounts because they simply do not have the understanding or interest and this is why I think that the education system needs to be looked at. We cannot put the responsibility all on parents because most people of parenting age nowadays are also simply unaware of how the world of money really works. The rule is simple that, give or take for ups and downs, The longer your money is invested, the more it benefits from compound interest, leading to financial independence.

Understanding the basics of investing

Investing can seem like a big, scary world, but it doesn’t have to be. Starting simple is the key. There are many ways to invest your money, and each has its own benefits and risks. Please subscribe to our free newsletter as we will be looking at ways to invest, the options available and guiding you through the process whether thats for yourself (at whatever stage of life you are at) or for your youngsters as they grow up. Some common types of investments include:

- Stocks / Shares: Buying a piece of a company.

- When you invest in the stock market you literally become an owner (amongst many millions of owners) of that company so your investment can grow through increased valuations and, in some cases dividend payments as the company grows. This should be carefully considered and a strategy put into place (I cover this in more detail on other articles within this site) because businesses can do well or flop and your investment returns (or losses) will directly reflect the performance of the company (or companies) you invest in over time.

- Diversifying your stock investments is one important strategy to minimise your risk. ETF (exchange traded funds) are something that are great for many beginner investors because your money can get spread across many companies that track certain indexes. Join the newsletter to know more about ETF´s and how they work.

- Bonds: Lending money to a company or government.

- These come in many flavours and are not without risks nor do they offer any guarantees but they can sometimes be more secure than stocks because they are backed by large corporate organisations or indeed governments.

- Mutual Funds: Pooling money with other investors to buy a mix of stocks and bonds.

- We will talk more about this in another article.

- Real Estate: Buying property to rent out or sell later.

- This can be done on your own or by investing into companies that are corporate landlords. Property does tend to go up in value over time and can, if done right, make a good investment but this also does depend on each individual and their goals

- Precious Metals: Gold, Silver and so on are often used by professional investors as they are considered stable and historically have always grown in value over time. Like any investment this is not guaranteed and certainly in the short term their price can go up as well as down but owning precious metals long term can often give solid returns. This is why banks, governments and other major authorities often hold gold in their reserved. You can buy gold, silver etc in many forms, from physically owning it to buying through ETF (exchange traded funds) where you hold a stake in it through a managed fund.

- Crypto Currency: This is something I don´t get involved in personally as it is not regulated in the same way that other things are – which is actually the key to why it is so popular! That being said, I do know people who believe very strongly in crypto long term and have substantial amounts of their money invested in it. It can be very volatile and there is no physical asset behind it so I don´t recommemnd jumping in unless you really know what you are doing.

- Pensions & Savings: Cash is king – so they say! It´s certainly always wise to have a certain amount of liquid assets (funds you can access immediately) and cash is the best way to do this but remember that cash looses value over time so keeping a shoebox filled with money is actually costing you money every day. Likewise, holding money in a non-interest paying bank account is basically doing the same thing, only adding the security that it´s less likely to go missing. If you are going to keep money in cash in a bank then shop around for the right deal that is giving you interest at least above inflation rates and gives you the access to the money in a way you feel comfortable. Pensions come in a number of shapes and sizes and we will talk more at a later date but before jumping in to a pension it is vital that you know where the money is going, how its being managed, how much is high risk, how much is low risk and what fees are involved because even when there are advantages (fiscal for example), sometimes alternative investment vehicles can be better to some peoples needs over time.

These are just some of the ways you can invest money so as you can see there is a lot to think about but the important thing is that if you can invest, even a small amount then you should be and your children should be learning the basics at least from a young age.

A word on tax

Nobody likes paying tax but it´s a fundamental part of the economy and society that we live in. Neither this article or any content on this site is designed to give you tax advice. Tax rules vary from country to country and indeed for every person depending on their individual circumstances and if you are not a tax wizard then it is highly recommended that you get tax advice before choosing your investment strategy. I am a firm believer that we should all pay our fair share of tax but also, we need to be efficient in how we plan for our taxes to ensure that we position out investments in a way that take full advantage of whatever tax breaks or options there are for us.

Risk & Reward – The importance of a balanced and diversified investment portfolio

When you invest, you take on some risk. But with risk comes the chance for reward. The key is to balance your investments so that you can grow your money while keeping risks low. This is called balancing your portfolio. A good mix might include some safe investments like bonds and some riskier ones like stocks.

Diversification means not putting all your eggs in one basket. By spreading your money across different types of investments, you can protect yourself if one investment doesn’t do well. For example, if you only invest in stocks and the stock market goes down, you could lose a lot of money. But if you also have bonds and real estate, those might do well even if stocks don’t.

Remember, investing is a journey. Start small, learn as you go, and keep your eyes on your long-term goals.

The role of financial education

Why schools should be teaching financial literacy

Financial literacy is a crucial skill that everyone should have. Understanding money from a young age can set the foundation for a secure future. In my opinion, schools should include financial education in their curriculum to help students grasp the basics of saving, investing, and budgeting. This knowledge can empower them to make informed decisions and avoid common financial pitfalls.

We can´t leave it all to the parents because we are living in a period when most people of parenting age also have a very poor understanding of finances and investing and this is not their fault, it goes back to how and what they were taught. I do believe parents should take time to study some basics and pass this information on to their kids, and one of the plans for this site over the coming months is to make as many resources available as possible so please do sign up for our free newsletter if you are a parent who would like to get free news and information and grow your knowledge to help set your family up for their financially independent future.

The impact of financial knowledge on independence

Being financially literate can significantly impact your life. It can help you achieve financial independence, reduce stress, and create a stable future. When you understand how to manage your money, you can make better choices and avoid debt. Financial knowledge gives you the tools to build wealth and secure your future.

Financial education is not just about making money; it’s about making smart decisions that lead to a better life. Start learning today and take control of your financial future.

Building wealth with small regular investments

Setting up automatic investment contributions

One of the easiest ways to start building wealth is by setting up automatic contributions. This means a small amount of money is regularly transferred from your bank account to your investment account. This method ensures you consistently invest without having to think about it. Over time, these small amounts can grow significantly due to compound interest.

Choosing the right type of investments and investment accounts

When it comes to investing, choosing the right accounts is crucial. There are various options available (which depends on your country, circumstances and so on), examples include things such as Individual Savings Accounts (ISAs) in the UK or pensions, Stock Broker accounts, insurances and much more. Each type of account has its own benefits and drawbacks. For instance, ISAs offer tax-free growth (always seek professional advice), while pensions can sometimes provide tax relief on contributions. It’s important to research and select the account that best suits your financial goals.

Tracking your investment progress over time

Keeping an eye on your investments is essential. Regularly tracking your progress helps you understand how your investments are performing and whether you need to make any adjustments. You can use online tools or apps to monitor your portfolio. This way, you can celebrate your milestones and stay motivated on your journey to financial independence. You really don´t have to be an expert but the more interest you show in your investments, the more fun it is and the more empowered you will feel to make appropriate adjustments when needed.

By starting young and investing small amounts regularly, you can build a retirement with a small amount and achieve financial independence. The key is consistency and making informed choices about where to invest your money.

Even if you didn´t start young and are now in your mid life thinking it´s too late – it is never too late! There are loads of ways that you can get started with investing, even with the smallest amount and there are many ways that you can reorganise your personal finances to have some money to invest so don´t ever feel you´ve missed your chance. As the saying goes, yesterday was the best day to start investing but today it the next best thing!

The culture of spending

Credit Cards, Loans & Overdrafts – Useful tools but dangerous traps!

Credit cards and loans can be tempting, but they often lead to overspending. It’s easy to swipe a card without thinking about the consequences. Remember, overcoming overspending habits is a journey that requires patience and self-compassion. By staying aware of your spending and setting limits, you can avoid falling into debt.

Debt is part of life but we should develop debt intelligence and think about how we use debt to our advantage. One of the first things to ask yourself (and this is where it gets tough psychologically) is this: If you are using a credit card for essential things like food and bills, and it´s the only way to keep going, then what can you do to change that? Credit cards offer flexible and convenient ways to borrow money and increase our spending power and yes, they can also come in very useful when life throws unforeseen things our way but on the whole (exceptions apply) unless you are paying the full balance each month, you are spending enormous amounts of money in interest each month and just as we discussed the compounding effect of savings, the same applies to credit cards – especially if we are paying the minimum payment each month.

“The bank increased my limit so I must be able to afford it“

This is something I have heard people say many times. Often boasting and feeling proud that their bank – a financial institution – trust them with a huge credit limit on their card but the fact is that the bank make a fortune from credit cards so over time, if you keep paying on time, meeting the minimum and always staying within your limit, it is highly likely that the bank will increase and give you more to spend. Why? Because the ideal situation for the bank is that you don´t pay off the full amount, that you continue to accumulate interest charges but that you can afford to maintain repayments above the minimum amount. Keep this up for long enough and you will have an impressive credit limit but your credit limit is not, nor should it ever be seen as “available money” or “a spending target”.

I´m not saying that we should all live like paupers and deny ourselves every pleasure in life. I am a firm believer that for our mental health and well being we all need to splash out sometimes but credit cards are expensive. If you are in a position where you can pay the balance off then you should. Unless you are perhaps enjoying a reduced rate or a zero interest period. Sometimes we have to ask ourselves “is it really necesary?” and if the answer is no then don´t buy it! And if the answer is yes but the only way to buy it is to increase the debt to a credit card company with no clear plan as to how it will ever be paid then we have to look at our lifestyle in general and make adjustments.

For bigger purchases it can often be an option to borrow money and again, I am not saying to never borrow money. It may be your only change to get that new kitchen that you desperately need but before you take out any loan, think about the cost, the final cost, look at the amount you are borrowing, make sure you try and set limits, shop around too and keep any interest payments that you make for anything as low as possible because that money is money that otherwise could be working very hard for you and your retirement or other plans somewhere down the line.

Overdrafts (the facility to dip into a negative balance on your bank account) can also be useful but they are designed as stop gaps and not something to be used continually and certainly not to be thought of as “available money”. You should always revise the costs for overdrafts and unless they are free and you are running them within their free boundaries then you need to sit down and work out the cost and the options. Sometimes for example, a small loan of a fixed amount to pay off the overdraft and reset your monthly budget may be much cheaper than continually paying fees or interest on an overdraft. Better still, some spending habit changes may buy you a bit of free cash to enable you to turn your situation around and “live within your means”.

One thing that clearly doesn’t make sense is to be investing money into (for example) a pension plan that may be bringing in (for example as a random figure) 5% interest, whilst you are paying 12% on a credit card minimum payment and however much every time you go over the overdraft limit.

Sitting down and having a clear picture of your finances is something that many people avoid. It´s often scary and painful but its one of those things that once you do it, you can be in control and by being in control you can make a plan, be motivated and change your life, both now and for the future. We will talk more about this in future posts.

Shifting Mindsets from Spending to Saving

Changing how you think about money is crucial. Instead of focusing on what you can buy, think about what you can save. This shift can help you build wealth over time. Here are some tips to help you get started:

- Set clear savings goals

- Track your spending

- Reward yourself for meeting savings milestones

Real-Life Stories of Financial Discipline

Hearing about others’ experiences can be inspiring. For example, some people manage to save a significant portion of their income by living simply and avoiding unnecessary purchases. These stories show that it’s possible to achieve financial independence by making small, regular investments and sticking to a budget.

There are many resources online such as The Money Saving Expert where you can get tips on how to save money, avoid unnecessary spending and get yourself organised. Overcoming the culture of spending isn’t easy, but with determination and the right strategies, you can achieve financial freedom.

The Long-Term Benefits of Early Investment

Achieving Financial Independence

Starting to invest early can help you reach financial independence sooner. This means you can choose to work less or even retire early. Imagine having the freedom to spend your time on what truly matters to you. Investing for the long term gives your money the greatest chance of growing in value.

Reducing Financial Stress in Later Life

When you start investing young, you build a financial cushion that can reduce stress as you get older. Knowing you have savings can make unexpected expenses less scary. This is why saving money is important.

Creating a Legacy for Future Generations

Early investments can grow into a substantial amount over time, allowing you to leave a legacy for your children or grandchildren. This can help them with education, buying a home, or starting their own investments.

Investing early is like planting a tree. The sooner you plant it, the bigger it will grow, providing shade and fruit for years to come.

Practical Steps to Start Investing Young

Starting to invest at a young age can set you on the path to financial independence. Here are some practical steps to get you started.

Understanding Fees and Charges

When you start investing, it’s important to understand the fees and charges associated with your account. These can include management fees, transaction fees, and other hidden costs. Knowing these fees will help you make better investment decisions and save money in the long run.

Setting Realistic Financial Goals

Set clear and achievable financial goals. Whether it’s saving for a house, a car, or how to become financially independent, having a goal will keep you motivated. Break down your goals into smaller, manageable steps and track your progress regularly.

Investing from a young age can make a huge difference in your financial future. Even small, regular contributions can grow significantly over time due to the power of compound interest.

By following these steps, you’ll be well on your way to a secure financial future. Remember, the key is to start early and stay consistent.

Conclusion

Starting young with even a small, regular investment can truly set you on the path to financial independence. It’s not about having a lot of money right away, but about understanding the value of time and consistency. By making smart financial choices early on, you can build a secure future for yourself. Remember, it’s never too early to start learning about money and making it work for you. With the right knowledge and habits, anyone can achieve financial freedom and enjoy the peace of mind that comes with it.