LIVE STREAMING VIDEO BELOW…..

The term “final countdown” might evoke images of space shuttles blasting off into the cosmos, but for investors eyeing AST SpaceMobile, it signifies a crucial milestone. In a few minutes we arrive at a moment that will either launch the company’s stock to new heights or temper the excitement that has built up over the past several months. The stakes are high as AST SpaceMobile prepares to deploy its first five BlueBird satellites. With so much riding on this launch, let’s explore what makes this event pivotal and what it could mean for investors.

While you are here, please do sign up for my free newsletter to keep in touch with the latest goings on and feel free to drop me a line and tell me about you and your investment / business journey!

The Excitement Leading Up to the Launch

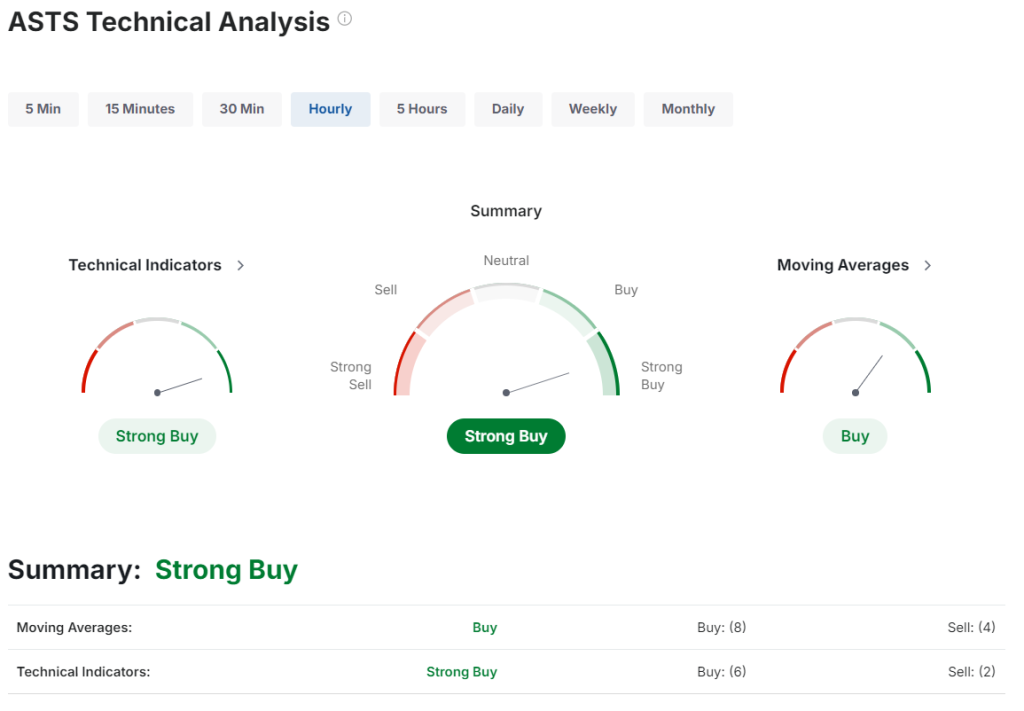

Imagine seeing a stock surge over 1,300% within a few months—that’s precisely the trajectory AST SpaceMobile (ASTS) has experienced since April. Rising from around $2 per share to nearly $30, the stock has captured the attention of many investors. This spectacular rise is largely due to the anticipation surrounding the launch of the BlueBird satellites, an event that many believe will validate the company’s technology and business model. The analysts seem pretty bullish on the stock at the moment, with most sources showing a buy rating. Here is the chart from investing.com (one you can access with a free account).

What is AST SpaceMobile?

For those unfamiliar, AST SpaceMobile aims to create the first and only space-based cellular broadband network. Essentially, the company plans to deliver global mobile connectivity directly to standard cell phones via satellites. This ambitious goal has attracted partnerships with major telecom giants like AT&T and Verizon, extending through 2030.

The Importance of the BlueBird Satellites

The BlueBird satellites are not just any satellites; they represent a significant technological leap. Once deployed, these satellites are expected to provide a 10-fold increase in processing capacity. Initially, they’ll offer broadband connectivity to 5,600 cell phones across the continental U.S. This would be a vital demonstration of the viability of AST SpaceMobile’s concept—a model that relies on direct satellite-to-mobile connectivity.

Analysts’ Optimism and the Stock’s Potential

Financial analysts have taken note of AST SpaceMobile’s potential. Deutsche Bank recently raised its price target for ASTS to a Street-high $63 from $22, citing an improved risk profile ahead of the launch. The average analyst price target hovers around $37. This bullish outlook is encouraging for investors, but it also adds pressure for the launch to go smoothly, hence the low estimates of around $15.

If all goes wrong today with the launch, or indeed over the coming weeks and months we could see hefty drops too so this stock is a mix of speculative value based on their impressive record to date, talks with potential clients of such scale and ambitious plans. But, like any speculative price, the rate today has had assumed success somewhat factored in to the valuation so do keep that in mind. The price targets shown below are courtesy of Seeking Alpha wall street analysts.

With recent insider stock purchases, this could be a sign of a deep confidence amongst those in the know. We have certainly been seeing strong increases in stock price in the last few months with the monthly charts from May showing long green candles all the way. The redness at the top is, in ,my opinion normal and to be expected at this critical point.

Challenges and Considerations

While the excitement is palpable, it’s essential to consider the volatility that could follow the launch. The stock has already rallied massively year-to-date, leading to some investor skepticism and high short interest. If the launch is successful, it could drive continued positive momentum. However, if there are hiccups, the stock might experience significant volatility.

The Live Launch Video

For those eager to witness this milestone, AST SpaceMobile is streaming the launch live. You can watch the event unfold here. This real-time experience provides a unique opportunity to be part of a potentially historic moment in satellite communications.

A Look at the Future

Even if the initial launch is successful, investors should remember that this is just the beginning. The real test will come when more satellites are launched, and the service becomes fully operational. The initial success could set the stage for a broader rollout, but the ultimate goal of global connectivity will take time to achieve.

The Business Model and Partnerships

One crucial aspect that will determine AST SpaceMobile’s success is how they model their partnerships with telecom providers. While the technology and strategic alliances with AT&T and Verizon are promising, questions remain about the revenue model. Will consumers be willing to pay a supplement for a service they may rarely use? Or will mobile providers include it as part of a fixed fee? These are essential considerations as the company moves forward.

Insight into Market Dynamics

The satellite communications market is fast-growing and highly competitive. AST SpaceMobile’s ability to carve out a niche will depend on more than just technology. Effective market penetration will require strategic pricing, robust partnerships, and seamless integration with existing mobile networks.

Potential Revenue Streams

Beyond direct consumer charges or telecom partnerships, other revenue streams could include enterprise solutions, government contracts, and IoT applications. Diversifying income sources will be crucial for long-term sustainability and growth.

Investor Sentiment and Market Impact

The overall sentiment among investors is cautiously optimistic. While there is excitement about the potential for significant returns, there’s also an understanding that the road ahead has its challenges. How the market reacts to the launch will be telling, but it’s clear that many are willing to bet on AST SpaceMobile’s vision.

Conclusion

AST SpaceMobile stands at a critical juncture. The launch of the BlueBird satellites could either propel the stock to new heights or introduce a period of volatility. While the excitement is understandable, investors should keep in mind that this is just the first step in a long journey towards global mobile connectivity. The partnerships with major telecom providers are promising, but the revenue model and actual market adoption will be key determinants of success.

The live launch is an event not to be missed, and you can watch it happen here. Whether you’re a seasoned investor or new to the market, the developments at AST SpaceMobile are worth keeping an eye on. The future of satellite communications is unfolding before our eyes, and AST SpaceMobile is at the forefront of this exciting frontier.